Sharon White, boss of John Lewis and supermarket chain Waitrose, has said the UK could see a double-digit inflation rate in 2022, the Guardian recently revealed. She pointed to soaring energy prices and war in Ukraine as the reason inflation could reach levels not seen in 40 years.

The claim certainly dovetails into the latest figures from the Office for National Statistics, which show inflation reached 6.2% in February 2022, the highest for three decades.

So, what could this mean for your finances? Read on to discover what inflation is, how it could affect your wealth and how you could inflation-proof your money.

Inflation is the rising cost of goods and services

Put simply, inflation is the rising cost of living and has the potential to affect everything from your utility bills to your weekly shop. This is because as prices rise, £1 in the future is likely to buy you less than £1 today.

While a small amount of inflation typically signals a healthy economy, if it becomes too high it can result in stagnation, which is why the Bank of England (BoE) aims to keep inflation at 2%.

To show how it can affect your finances, an inflation calculator reveals you would need £186 today to have the same spending power as £100 in 2002. This means your money needed to grow 85.6% during the period to keep pace with an average inflation rate of 3.1% a year. If it didn’t, your money dropped in value in real terms.

As you can see, the average 3.1% during the 20-year period is significantly lower than February’s inflation rate of 6.2%.

A “perfect storm” of factors has seen inflation soar

Inflation has skyrocketed because of a perfect storm of events. This included Britain’s economy bouncing back after Covid lockdowns, which resulted in inflation rising as people shopped and socialised again.

At the same time, supply chain issues caused by the pandemic resulted in prices going up, which pushed up the cost of living even further.

If that wasn’t enough, demand for energy and fuel increased, resulting in a price hike and further inflation. This was exacerbated by Russia’s invasion of Ukraine, which resulted in economic sanctions on the Kremlin leading to more increases in fuel and energy prices.

Interest rates are likely to rise because of inflation

Historically, central banks like the BoE use interest rates to help control the spiralling cost of living. This is because a major driver of inflation is demand, so higher interest rates can make saving a better option than spending.

That’s why the BoE increased its interest rate to 0.75% in March 2022. While the Times reveals many experts believe the rate could increase to 1.25% by the end of the year, rates offered for savings accounts are likely to remain significantly below inflation.

That said, rising interest rates could see repayments for some mortgages increase – something we will look at shortly.

You might be able to inflation-proof your money

There is good news though, as there are ways to potentially protect your wealth from the effects of inflation. Let’s consider three of them.

Invest your money

While the stock market has seen an uncertain start to 2022, over the long term it typically provides greater potential growth than cash savings.

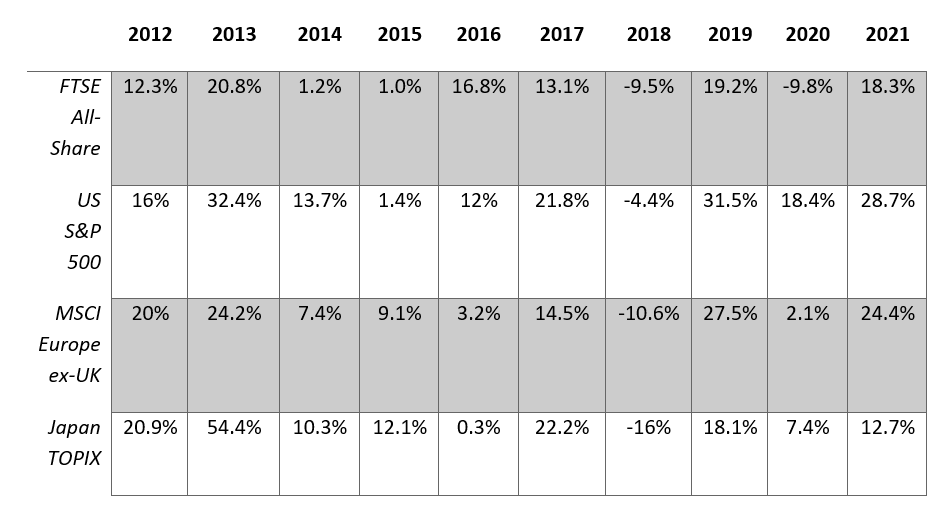

This is illustrated by the following table, which shows the annual returns of some of the major stock indices over the 10 years to 2021. As you can see, while there are one or two exceptions, the stock markets broadly produced positive annual returns during the period despite Brexit and the Covid pandemic.

Source: JP Morgan, FTSE, MSCI, Refinitiv Datastream, Standard & Poor’s, TOPIX, J.P. Morgan Asset Management. All indices are total returns in local currency, except for MSCI Asia ex-Japan and MSCI EM, which are in US dollars. Past performance is not a reliable indicator of current and future results. Data as of 31 January 2022.

This means that investing your money could help inflation-proof your cash over the long term. Please remember, past performance is not a reliable indicator of future performance.

Rebalance existing investments

If you already have investments, the assets within them – such as stocks and shares and government bonds – could increase or decrease in value over time, which could affect the overall balance of your portfolio.

Rebalancing your investments may realign them to where they should have been originally, which could improve growth potential and possibly provide greater protection against inflation.

Fix your mortgage

As interest rates rise, so too does the cost of borrowing. According to Money Saving Expert, a 25-year mortgage of £250,000 with a 3.5% interest rate would cost £1,252 a month.

If that increases by just 0.5%, monthly repayments increase to £1,319, meaning you would pay an additional £20,116 during the term of the loan.

If you have a variable- or tracker-rate mortgage, you may have already seen your repayments rise in recent weeks. If you have a fixed-rate mortgage, it will typically remain the same until your deal ends.

So, if you’re on a variable- or tracker-rate, or your fixed-rate is about to end, searching for a competitive fixed-rate mortgage could be a very shrewd move.

Get in touch

If you would like to discuss the possible effects of inflation on your money, and ways you could help deal with it so that you can enjoy the lifestyle you deserve, please get in touch on 0116 262 1414.

As specialists in providing holistic, female-focused financial planning, we provide financial coaching to help build confidence and understanding around your wealth. This helps you become more comfortable when making financial decisions, allowing you to look forward to a brighter tomorrow and a lifestyle you aspire to.

Please note

This article is for information only. Please do not act based on anything you might read in this article until you have sought professional advice.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it. Buy-to-let (pure) and commercial mortgages are not regulated by the FCA.

Think carefully before securing other debts against your home.

Production

Production